Top Five Estate Planning Mistakes

Overlooking an important step or making a blunder can derail all your careful planning, leaving your heirs and beneficiaries with a headache-inducing challenge.

Overlooking an important step or making a blunder can derail all your careful planning, leaving your heirs and beneficiaries with a headache-inducing challenge.

Avoidance of estate taxes is one consideration in estate planning, but the estate tax system only applies to the wealthy. The income tax, however, applies to EVERYONE, and improper income tax planning often creates unnecessarily large income tax liabilities for the heirs of middle income Americans.

Portability allows the predeceasing spouse’s unused estate tax exemption to be used at a later time for the estate of the surviving spouse. But for better estate tax planning results, large estates shouldn’t solely rely on portability to reduce their esate taxes.

Upstream basis planning is a trust strategy that can save wealthy people on their capital gains taxes and income taxes associated with highly appreciated assets.

The IRS is weighing a change that could leave your heirs poorer than you might hope.

Trusts could be an incredibly powerful tool to help business owners protect their business and reach their wealth goals.

Ben Franklin once said, ‘… nothing can be said to be certain, except death and taxes.’ For all certainties in life, the best thing you can do is plan for their eventual occurrence.

One of the most overlooked and misunderstood tax laws – available to married farming couples – is an opportunity called portability.

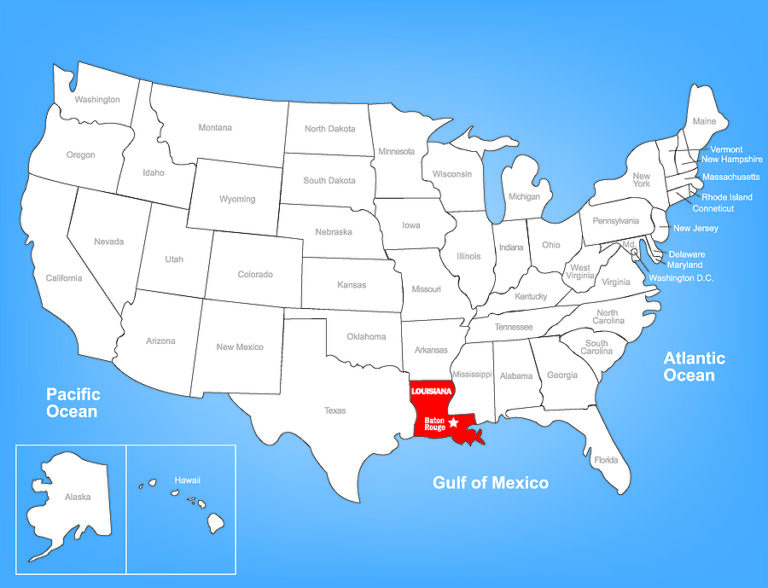

You may have heard the term “community property.” However, do you know exactly what it means or how it could affect you?

In 2017, Congress doubled the exemption starting in 2018, and the amount will continue to rise with inflation through 2025. This expansion helped reduce the number of taxable estates to about 1,300 for returns filed in 2020 from about 5,200 in 2017, according to the latest IRS data.

3112 Jackson Street

Alexandria, LA 71301

1070-B West Causeway Approach

Mandeville, LA 70471