Why Is Beneficiary Designation Important?

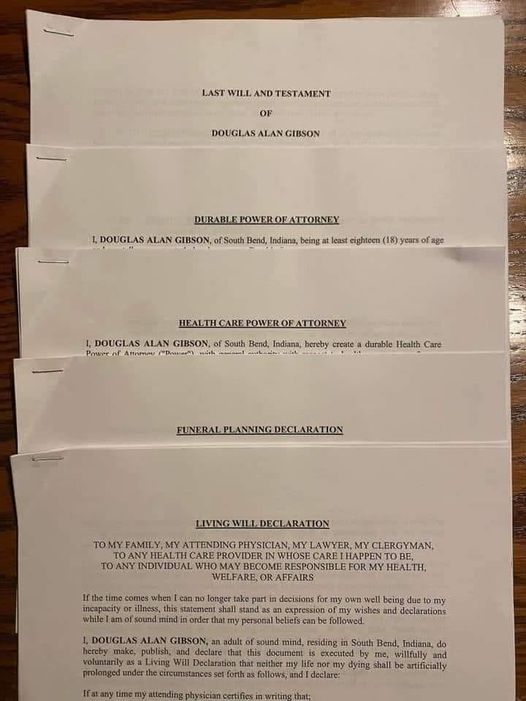

When you set up your estate plan it is important to coordinate the legal planning documents that you or you and your attorney create with the document provided by your retirement account custodian and/or your life insurance carrier called a ‘Designation of Beneficiary.’